Takeda Announces Details of New Business Venture with Teva in Japan

Takeda Announces Details of New Business Venture with Teva in Japan

Splitting off (absorption-type split) of Takeda's Long Listed Products Business and its Subsequent Succession by Teva

Osaka, Japan, December 28, 2015 – Takeda Pharmaceutical Company Limited (TSE: 4502) ("Takeda") today announced the details of the business venture which was disclosed November 30, 2015 in the press release titled, "Teva and Takeda establish unique partnership to meet the wide-ranging needs of patients and growing importance of generic medicines use in Japan".

[http://www.takeda.com/news/2015/20151130_7215.html]

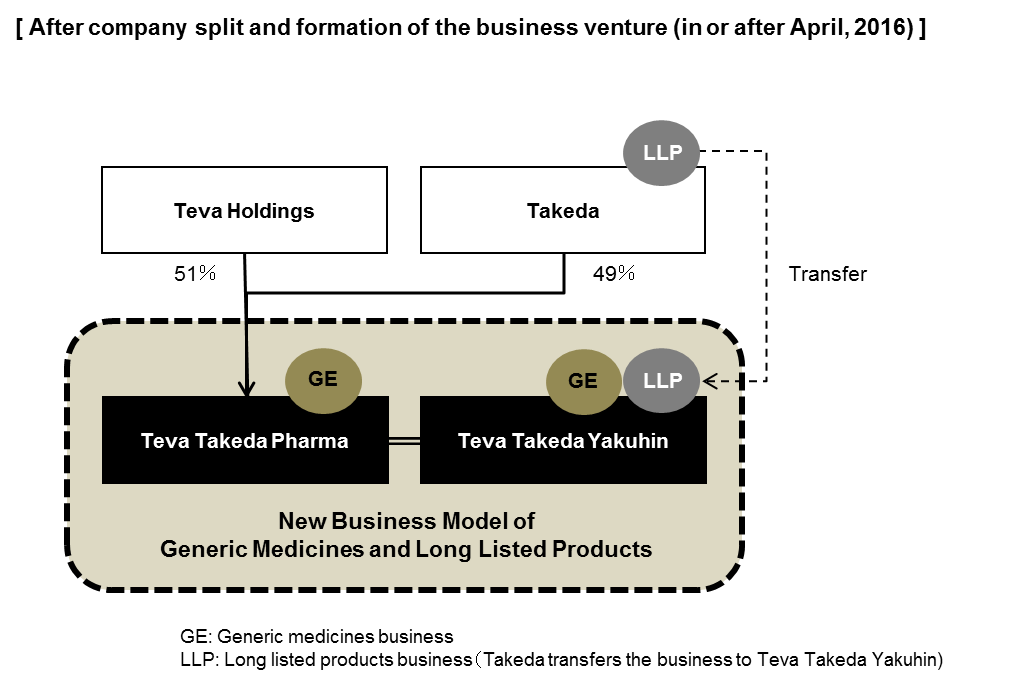

Takeda will split off its off-patented and data exclusivity expired products business ("long listed products business") via an absorption-type split, and subsequently the business will be succeeded by the Japanese subsidiaries of Teva Pharmaceutical Industries Ltd. of Israel.

This is a triangular absorption-type company split among Teva Pharma Japan Inc. ("Teva Pharma") and Taisho Pharm. Ind., Ltd. ("Taisho Pharm"), as well as Takeda. In this absorption-type company split, Takeda will be the splitting company and Taisho Pharm will be the succeeding company. Takeda's long listed products business will be transferred to Taisho Pharm, and Taisho Pharm will allocate shares of Teva Pharma, which will become its parent company, to Takeda as consideration for the company split. The company name of Taisho Pharm, which will succeed Takeda's long listed products business and also continue its generics business, will become Teva Takeda Yakuhin Ltd. ("Teva Takeda Yakuhin"), and the company name of Teva Pharma, which will continue its generics business, will become Teva Takeda Pharma Ltd. ("Teva Takeda Pharma"). Both companies will jointly engage in the new business.

Teva will hold 51% of Teva Pharma's shares through Teva Holdings KK ("Teva Holdings"), which is also the Japanese subsidiary of Teva, and Takeda will hold 49% of Teva Pharma's shares.

The new business venture of Teva Takeda Pharma and Teva Takeda Yakuhin (collectively, "the new companies"), to be established in or after April 2016, will deliver Teva's high-quality generic medicines and Takeda's long listed products to patients and healthcare professionals in Japan. Its aim is to become a leading off-patent product (including generic medicines and long listed products) company in Japan, leveraging Takeda's corporate brand and the unique distribution network that has been built through Takeda's longstanding business in Japan, and Teva's wide product portfolio and cutting-edge business efficiency.

As this company split is expected to correspond to certain criteria of the Tokyo Stock Exchange in terms of changes in Takeda's total assets and revenue, part of disclosure items and contents are omitted.

1. Purpose of company split

This strategic move between Takeda, an R&D driven pharmaceutical company which has a long history as a leading company in Japan, and Teva, which is among the top ten pharmaceutical companies in the world and a global leader in generics, will form the new companies to meet the wide-ranging needs of patients and correspond to the growing importance of generics in Japan, by delivering Takeda's transferred long listed products and Teva's generic medicines. The Japanese generics market is one of the fastest growing in the world, and is expected to continue its high growth driven by social requirements such as increased patient need for the stable supply of affordable high quality medicines, and the Japanese government's initiatives to control healthcare expenditure. Takeda's leading brand reputation and strong distribution presence in Japan combined with Teva's global expertise in supply chain, operational networks, commercial deployment, and R&D and scientific insight, brings forward a new, collaborative business model in line with government objectives that will ultimately serve millions of patients. Moreover, Takeda will further strengthen its initiatives to lead innovation in medicine through providing innovative new drugs.

2. Details of company split

1) Schedule of company split

| Date of conclusion of the definitive agreement to establish a business venture via a company split | November 30, 2015 |

| Effective date of the company split | In or after April, 2016 (TBD) |

(Note) The company split is to be conducted by Takeda as defined in Paragraph 2, Article 784, of the Companies Act.

Accordingly, no approval by a general meeting of shareholders as defined in Paragraph 1, Article 783 of the Companies Act is required.

2) Method of company split

In this company split, Takeda will be the splitting company and Taisho Pharm will be the succeeding company. More specifically, Teva Pharma will carry out a stock exchange with Teva Holdings, and thereby Taisho Pharm will become a fully owned subsidiary of Teva Pharma. Taisho Pharm will then allocate shares of Teva Pharma to Takeda.

3) Details of stock allocation

As consideration for the company split, Taisho Pharm will allocate 49% of shares of Teva Pharma to Takeda. As a result, Teva Holdings and Takeda will hold 51% and 49% shares, respectively, of the total shares issued by Teva Takeda Pharma, whose name will be changed from Teva Pharma.

4) Treatment of stock options and corporate bonds with stock options for the splitting company

Although Takeda has issued stock options, there will be no change to the treatment of these stock options due to the company split.

5) Increase or decrease of capital stock due to the company split

There will be no change in Takeda's capital stock due to the company split.

6) Rights and obligations to be succeeded by the succeeding company

Taisho Pharm will succeed the assets relating to Takeda's long listed products business covered by the absorption-type company split agreement, as well as the rights and obligations incidental thereto.

7) Capability of satisfying liabilities

It has been judged that Taisho Pharm will not have any problem in performing its obligations relating to the liabilities it will bear following the effective date of the absorption-type company split; however, it does not guarantee that Takeda will bear a responsibility of those liabilities.

3. Calculation of share allotment relating to the company split

Taking into consideration the results of calculations by the third-party appraiser of the long listed products business of Takeda (the splitting company), and the generic medicine businesses of both Taisho Pharm (the succeeding company), and Teva Pharma, Takeda and Teva have comprehensively considered the relevant factors such as the respective states of finances and assets, as well as forecasts for the future, and after a series of deliberations have ultimately agreed upon the abovementioned shareholding ratio.

4. Outline of the companies

| Splitting company (As of March 31, 2015) | ||

| (1) Company name | Takeda Pharmaceutical Company Limited | |

| (2) Location | 1-1, Doshomachi 4-chome, Chuo-ku, Osaka 540-8645, Japan | |

| (3) Representative | President & CEO: Christophe Weber | |

| (4) Scope of business | Research & development, manufacturing, sales and marketing of pharmaceutical products, etc. | |

| (5) Capital | 64,044 million yen | |

| (6) Date established | January 29, 1925 | |

| (7) Number of shares issued | 789,923,595 shares | |

| (8) Fiscal year end | March 31 | |

| (9) Major shareholders and ratio of shares held | Nippon Life Insurance Company The Master Trust Bank of Japan, Ltd. (Trust account) Japan Trustee Services Bank, Ltd. (Trust account) JP Morgan Chase Bank 380055 Takeda Science Foundation | 6.43% 3.93% 3.37% 2.45% 2.27% |

| (10) Financial results of the previous fiscal year (consolidated, IFRS) | ||

| Equity attributable to owners of the Company | 2,137,047 million yen | |

| Total assets | 4,296,192 million yen | |

| Equity attributable to owners of the Company per share | 2,719.27 yen | |

| Revenue | 1,777,824 million yen | |

| Operating profit | (129,254) million yen | |

| Profit before income taxes | (145,437) million yen | |

| Profit attributable to owners of the Company | (145,775) million yen | |

| Basic earnings per share | (185.37) yen | |

| Succeeding company (As of December 31, 2014) | ||

| (1) Company name | Taisho Pharm. Ind., Ltd. | |

| (2) Location | 3, Ohara Ichiba, Koka-chou, Koka-shi, Shiga Prefecture 520-3433, Japan | |

| (3) Representative | President: Ichiro Kikushige | |

| (4) Scope of business | Development, manufacturing, sales and marketing of pharmaceutical products | |

| (5) Capital | 700 million yen | |

| (6) Date established | February 6, 1959 | |

| (7) Number of shares issued | 11 shares | |

| (8) Fiscal year end | December 31 | |

| (9) Major shareholders and ratio of shares held | Teva Holdings KK | 100% |

| (10) Financial results of the previous fiscal year (consolidated, IFRS) | ||

| Total equity | 3,359 million yen | |

| Total assets | 13,907 million yen | |

| Equity per share | 305,368 thousand yen | |

| Net sales | 12,947 million yen | |

| Operating income | 360 million yen | |

| Ordinary income | 299 million yen | |

| Net income | 270 million yen | |

| Earnings per share | 24,575 thousand yen | |

| Company that will have its shares allocated to the splitting company (As of December 31, 2014) | ||

| (1) Company name | Teva Pharma Japan Inc. | |

| (2) Location | 1-24-11, Taiko, Nakamura-ku, Nagoya, Aichi Prefecture, Japan | |

| (3) Representative | President and CEO: Ichiro Kikushige | |

| (4) Scope of business | Research and development, manufacturing, sales and marketing of pharmaceutical products | |

| (5) Capital | 430 million yen | |

| (6) Date established | April 1, 2012 | |

| (7) Number of shares issued | 614 shares | |

| (8) Fiscal year end | December 31 | |

| (9) Major shareholders and ratio of shares held | Teva Holdings KK | 100% |

5. Outline of the business to be split off from Takeda to the succeeding company

1) Details of the business to be split off

The portion of the business to be split off is Takeda's long listed products business, excluding a specific proportion of long listed products, vaccines, narcotic products and in-licensed products.

2) Financial results of the business to be split off

Revenue of the business to be split off (Takeda's long listed products to be transferred to the succeeding company) is as follows;

| Full-year sales for the previous fiscal year | |

| Business to be split off (Takeda's long listed products to be transferred to the succeeding company) | Approximately 125 billion yen |

3) List and amount of assets and liabilities to be split off

Assets to be split off are mainly comprised of intangible assets of Takeda's long listed products (book value: negligible) and inventory of those products as of the effective date. Liabilities are not included in the split off.

The products scheduled to be transferred to the succeeding company include, amongst others, BLOPRESS (excluding fixed dose combinations), a treatment for hypertension, TAKEPRON (excluding fixed dose combinations), a treatment for peptic ulcers, and BASEN, a treatment for type 2 diabetes. Prostate cancer drug LEUPLIN is not subject to this transfer.

Furthermore, approximately 60 employees, mainly from the sales department of Takeda, are scheduled to be placed in the new companies accompanying the company split.

6. Status after the company split

There will be no change in Takeda's company name, location, representative, scope of business, capital and fiscal year end after the company split.

After the company split, the outline of the succeeding company, Taisho Pharm, is as follows. The company name will be changed to Teva Takeda Yakuhin Ltd.

| Succeeding company | ||

| (1) Company name | Teva Takeda Yakuhin Ltd. | |

| (2) Location | TBD | |

| (3) Representative | TBD | |

| (4) Scope of business | Development, manufacturing, sales and marketing of pharmaceutical products | |

| (5) Capital | TBD | |

| (6) Date of name change | In or after April, 2016 (TBD) | |

| (7) Number of shares issued | 11 shares | |

| (8) Fiscal year end | December 31 | |

| (9) Major shareholders and ratio of shares held | Teva Takeda Pharma Ltd. | 100% |

After the company split, the outline of Teva Pharma, the company that will have its shares allocated to Takeda, is as follows. The company name of the business venture will be changed to Teva Takeda Pharma Ltd.

| Company that will have its shares allocated to the splitting company | ||

| (1) Company name | Teva Takeda Pharma Ltd. | |

| (2) Location | TBD | |

| (3) Representative | TBD | |

| (4) Scope of business | Development, manufacturing, sales and marketing of pharmaceutical products | |

| (5) Capital | TBD | |

| (6) Date of name change | In or after October, 2016 (TBD) | |

| (7) Number of shares issued | TBD | |

| (8) Fiscal year end | December 31 | |

| (9) Major shareholders and ratio of shares held | Teva Holdings KK Takeda Pharmaceutical Company Limited | 51% 49% |

7. Outline of accounting procedures

Takeda's accounting treatment for the company split will be conducted based on IAS28 "Investments in Associates and Joint Ventures." While gains on transfer business and goodwill, etc. are predicted, their amount is yet to be calculated. The goodwill, etc., if any, would be included in "investments accounted for using the equity method," not "goodwill."

8. Future outlook

1) Financial impact to Takeda in the fiscal year ending March 31, 2016 (FY2015)

Because the effective date of the company split is anticipated in or after April, 2016, there is no expected material impact on Takeda's consolidated financial results for FY2015.

2) Financial impact to Takeda in the fiscal year ending March 31, 2017 (FY2016)

Takeda has not yet disclosed a forecast of the consolidated financial results for FY2016. The impact of the company split on the consolidated financial results is under consideration. However, the impact is roughly evaluated as follows;

- Although revenue of the long listed products to be transferred to the succeeding company amounted to approximately 125 billion yen in FY2014 (7% of Takeda's global revenue), the sales of large products such as BLOPRESS have been significantly declining in FY2015 due to the penetration of generic products, and a further decline in sales is anticipated in FY2016.

-

Takeda will book revenue for the services related to its supply of the long listed products of the subject and its distribution using Takeda's channel to deliver products including the generic products of the new companies (Teva Takeda Pharma and Teva Takeda Yakuhin) to healthcare providers. As a result of the transaction, Takeda's FY2016 revenue is estimated to decrease by approximately 50 billion yen, based upon current assumptions.

- Regarding operating profit, the decrease in net revenue would also impact the operating profit of Takeda. However, a non-cash, one-off gain from the transfer of intangible assets associated with the long listed products is anticipated to have a positive impact on operating profit during FY2016. The exact amount of the impact is still under evaluation.

- Takeda will book 49% of the net profit of both Teva Takeda Pharma and Teva Takeda Yakuhin, which will be included in the income statement account line "share of profit of associates accounted for using the equity method".

- For FY2016, Takeda anticipates a significant positive impact on EPS, in addition to a positive impact on cash flow.

- In summary, Takeda anticipates that the impact of the transaction will be both EPS and cash flow accretive in FY2016 and over the long-term due to growth of the generic business and the addition of products from Takeda and Teva to the new companies. All impacts will be incorporated into Takeda's FY2016 forecast which will be communicated in May 2016.

9. Other

The company split assumes that the waiting period based on the Act on Prohibition of Private Monopolization and Maintenance of Fair Trade, as well as international competition laws, has expired, and there are no factors that will interfere with the execution of this company split agreement such as cease and desist orders from the Japan Fair Trade Commission or any international competition regulatory organizations.

###

Located in Osaka, Japan, Takeda (TSE: 4502) is a research-based global company with its main focus on pharmaceuticals. As the largest pharmaceutical company in Japan and one of the global leaders of the industry, Takeda is committed to strive towards better health for people worldwide through leading innovation in medicine. Additional information about Takeda is available through its corporate website, www.takeda.com.

Investor Contacts:

Noriko Higuchi

noriko.higuchi@takeda.com

+81 3-3278-2306

Media Contacts:

Tsuyoshi Tada

tsuyoshi.tada@takeda.com

+81 3-3278-2417