Business Report: 148th Interim Period | Takeda Pharmaceuticals

Business Report: The 148th Interim Period

Creating better health for people and a brighter future for the world is our purpose. The science and technology we advance are constantly evolving. But through our enduring values, our ambition remains steadfast. We strive to deliver truly transformative treatments, contributing significant value to society while creating an exceptional experience for our people.

Dear Takeda Shareholders,

I am thankful for your support and continued confidence in Takeda. Reflecting on the first half of fiscal year 2024, we had strong momentum in our Growth & Launch Products and continued to progress our late-stage pipeline. Coupled with continued execution of our multi-year efficiency program, we are achieving our milestones, delivering on our financial commitments and creating long-term value for our stakeholders. We are pleased to have raised our full year Management Guidance for FY2024, reflecting our stronger than anticipated first half performance. We are proud of the progress we’ve made during the first half of the year and remain confident in our trajectory to return to sustainable growth.

Click below to read more

Several of our recent product launches, including FRUZAQLA® (fruquintinib), ADZYNMA® (ADAMTS13, recombinant-krhn) and EOHILIA® (budesonide oral suspension), have resulted in strong initial uptake, underscoring their future potential and proven ability to address patient needs. We expect these products to continue to grow as we expand geographically with recent approvals, such as for ADZYNMA in the European Union and FRUZAQLA in Japan. Importantly, we have also seen a return to double-digit growth in ENTYVIO® (vedolizumab) in the first half, largely driven by the launch of ENTYVIO Pen in the U.S. This is a notable achievement for ENTYVIO after 10 years on the market and in a highly competitive treatment landscape, but it nonetheless fell below our expectations due to lower than anticipated overall market growth and access complexity. We have seen significant advancement in patient coverage in the U.S. since July 2024, however, and continue to drive improvements along the access pathway.

Our progress in the multi-year efficiency program first announced in May 2024 is in line with our plan. We have already implemented structural changes across several corporate and regional functions to enhance organizational agility, identified opportunities to unlock savings and maintained our focus on embedding data, digital & technology to drive efficiencies and productivity that can be seen across our value chain.

At the same time, we continue to invest in our innovative pipeline for future growth and now have multiple programs in Phase 3 development. These late-stage programs represent potential treatments for conditions including narcolepsy type 1, psoriasis and other rare and more prevalent diseases with high medical need. We’re excited about the transformative potential of our pipeline and look forward to sharing additional details during our upcoming R&D Day on December 13 JST.

Looking ahead to the next six months and beyond, we anticipate continued strong performance from our Growth & Launch Products, exciting pipeline progressions and continued momentum. On behalf of Takeda, I greatly appreciate your support as we continue to work to discover and deliver life-transforming treatments.

Warm regards,

Christophe Weber, President & CEO Takeda Pharmaceutical Company Limited

Feature

In Pursuit of a Life-transforming Treatment for Narcolepsy

Narcolepsy is a chronic disorder with debilitating symptoms1 that lead to a markedly reduced quality of life and can severely impact job performance, academic achievement and personal relationships. Despite its severity, narcolepsy remains largely misunderstood and underappreciated. Through our orexin research program, we aspire to develop transformative medicines for people living with this rare disease and other conditions.

Click below to read the full article.

Heavy Patient Burden Often Includes Delayed Diagnosis

Narcolepsy is classified into two different types: narcolepsy type 1 (NT1), caused by significant loss of orexin neurons resulting in a reduction of orexin, and narcolepsy type 2 (NT2), where orexin levels are generally normal. Patients with NT1 experience a wide range of symptoms that significantly impair their daily life. These symptoms include excessive daytime sleepiness, cataplexy (sudden muscle weakness when exhibiting strong emotions), disrupted nighttime sleep, sleep hallucinations, sleep paralysis, cognitive impairment and fatigue.1 Moreover, patients report that the burden goes far beyond core symptoms, impacting their physical, mental and social health.2 This can include some people with NT1 reporting difficulties in socializing, performing well in school or work, exercising, staying focused, performing household duties and driving. The inability to participate in many aspects of everyday life, the exhaustion of constantly resisting sleep and the isolation and stigma of the disease lead to severe impacts on the psychological and emotional well-being of patients. Compounding the challenges they face is the fact that it can often take over 10 years on average for a person to receive an accurate diagnosis2,3,4 as symptoms may be masked by other conditions or simply perceived to be due to lack of adequate sleep.4,5 Symptoms of NT1 can vary widely in type and severity. Because narcolepsy is often not recognized and carries a stigma, it can also be overlooked in favor of more commonly diagnosed conditions.

Learn more about the impact of narcolepsy through one person’s experience in NT1, and the potential of wearable technology may have towards improving accurate diagnosing.

Potential to Establish New Standard of Care

Individuals with NT1 experience a loss of orexin neurons, which leads to low levels of orexin and consequently disrupts downstream signaling.1 This destabilizes the sleep-wake cycle and can induce sleep even when not intended.

Discovered at our research site in Shonan, Japan, TAK-861* is an investigative oral orexin receptor 2 agonist, currently in clinical studies, designed to bind and stimulate the orexin receptor 2 and help restore orexin signaling in people with NT1.6 No currently approved treatments target the underlying pathophysiology of NT1. TAK-861 has the potential to be the first in a new class of medicines designed to address this fundamental aspect of the disease. By targeting the root cause of NT1, TAK-861 aims to potentially address a broader spectrum of symptoms and improve the overall disease burden and functional impact, ultimately establishing a new standard of care.

Now in Phase 3 Clinical Trials

Phase 2b data for our clinical trial studies of TAK-861 presented at medical congresses in the field of sleep medicine and research in June and September 20246 have shown promising results, demonstrating meaningful impact of this investigative compound on wakefulness and sustained reduction in cataplexy as compared to placebo. Data also highlighted the impact of TAK-861 on daily functioning, including cognition and sleep quality, as well as long-term safety and efficacy with some patients reaching one year of treatment under clinical trials.6 Phase 3 clinical trials for TAK-861 in NT1 were initiated in August 2024. We are also progressing orexin agonist research in other rare sleep-wake disorders with overlapping clinical features of NT1, such as excessive daytime sleepiness, but with normal levels of orexin including NT2 and idiopathic hypersomnia (IH). This includes TAK-360*, another investigative oral orexin receptor 2 agonist, which is being investigated in a Phase 1 healthy volunteer trial and will be developed for NT2 and IH.

In addition to therapeutic innovation, we are taking a holistic approach to addressing unmet needs throughout the patient journey – from symptom onset to treatment management and outcomes – by advancing diagnosis through digital innovation and data generation.

Haruhide Kimura, in our Neuroscience Drug Discovery Unit at the Shonan research site who has long been closely involved in our orexin franchise says,

“When I speak with people at medical congresses, I am reminded of the high expectations that patients and other researchers have for our TAK-861 program. We believe it has the potential to be a first-in-class narcolepsy type 1 treatment, and our teams are highly motivated to realize this potential.”

You can learn more about our pipeline at Takeda’s R&D Day event on December 13 JST, which will provide a deep dive into our late-stage pipeline programs. During the session, we will discuss the needs that exist for new treatment options for patients living with the conditions these potential therapies aim to treat, Phase 3 study designs, timelines, competitive positioning and commercial potential. An on-demand replay of the event and presentation material will be posted on our website.

*We are currently conducting clinical trials of TAK-861 and TAK-360. They have not been approved for NT1 or any other indications and there is no guarantee they will be approved for such use or indication.References

1. Scammell TE (2015) Narcolepsy. N Engl J Med 373(27):2654–2662, ICSD-3 TR - Disorders of central hypersomnolence

2. Maski K, et al. J Clin Sleep Med. 2017;13(3):419-425. doi: 10.5664/jcsm.6494; 6. US FDA. Narcolepsy & Idiopathic Hypersomnia: FDA Patient-Led Listening Session Summary Report

3. Luca G, et al. J Sleep Res. 2013;22(5):482-495. doi: 10.1111/jsr.12044;

4. Ohayon MM, et al. Sleep Med. 2021;84:405-414. doi: 10.1016/j.sleep.2021.06.008.

5. Telt sch DY, et al. Poster (P296) presented at: The 38th Annual Meeting of the Associated Professional Sleep Societies; June 1-5, 2024; Houston, TX, USA;

6. Dauvilliers Y. Oral presentation (LBA1318) at: The 38th Annual Meeting of the Associated Professional Sleep Societies; June 1-5, 2024; Houston, TX, USA

FY2024 H1 Financial Highlights

Our strong financial performance in the first half of FY2024 was driven by continued momentum in our Growth & Launch Products*, which grew 18.7% at constant exchange rate (CER) representing 47% of total revenue. First half results also benefitted from phasing of R&D investment, which we expect to ramp up in the second half due to progress in multiple Phase 3 programs. Core Revenue and Core Operating Profit grew 5.0% and 12.9%, respectively at CER, while reported Operating Profit grew 194.0% at actual exchange rates, mainly due to non-core items booked in FY2023.

*Please refer to slide 5 of Takeda’s FY2024 Q2 investor presentation (available at www.takeda.com/investors/financial-results/quarterly-results) for the definition of Growth & Launch Products.(Billion yen, except percentages and per share amounts)

| Item | FY24 H1 | FY23 H1 | vs. PRIOR YEAR (Actual % change) |

|---|---|---|---|

| Revenue | 2,384.0 | 2,101.7 | +13.4% |

| Operating Profit | 350.6 | 119.2 | +194.0% |

| Net Profit | 187.3 | 41.4 | +352.8% |

| EPS (Yen) | 119 | 27 | +348.4% |

| Operating Cash Flow | 451.3 | 291.3 | +54.9% |

| Adjusted Free Cash Flow (Non-IFRS) | 247.5 | -71.1 | N/A |

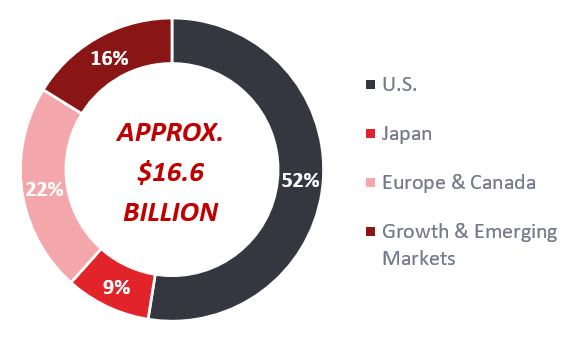

Revenue by Region

FY2024 H1 total global revenue of approximately $16.6 billion*; the U.S. accounted for 52%, Europe and Canada for 22%, Growth & Emerging Markets for 16% and Japan for 9%.

*Convenience translation has been made at an exchange rate of 1 USD = 143.25 JPY.Core (Non-IFRS)

(Billion yen, except percentages and per share amounts)

| Item | FY2024 H1 | FY2023 H1 | vs. PRIOR YEAR (Actual % change) | vs. PRIOR YEAR (CER % change) |

|---|---|---|---|---|

| Revenue | 2,384.0 | 2,101.7 | +13.4% | +5.0% |

| Operating Profit | 719.9 | 588.8 | +22.3% | +12.9% |

| Margin | 30.2% | 28.0% | +2.2pp | ― |

| Net Profit | 489.1 | 407.7 | +20.0% | +8.9% |

| EPS (Yen) | 310 | 261 | +18.8% | +7.9% |

Commercial Updates Across Six Key Business Areas

Growth in our key business areas in the first half of FY2024 was driven largely by the strong momentum of our Growth & Launch Products, which delivered revenue of 1,127.0 billion yen, marking an 18.7% increase on a CER basis.

695.2 billion yen in reported revenue, grew +7.6% on a CER basis.

388.7 billion yen in reported revenue, grew +5.3% on a CER basis.

535.7 billion yen in reported revenue, grew +14.3% on a CER basis.

The PDT portfolio continued to deliver outstanding growth, fueled by strong global demand for Immunoglobulin (+15.9% at CER), especially in the U.S., coupled with steady and growing supply. Furthermore, Albumin demonstrated solid growth (+11.0% at CER) with particularly strong demand for albumin products in China.

285.0 billion yen in reported revenue, grew +18.7% on a CER basis.

38.1 billion yen in reported revenue, grew +107.0% on a CER basis.

314.6 billion yen in reported revenue, declined 12% on a CER basis.

FY2024 Forecast and Management Guidance

We have raised our FY2024 Management Guidance, primarily due to milder than anticipated generic erosion of VYVANSE and strong business momentum in the first half. Upgraded full year reported and Core forecasts also reflect updated foreign exchange assumptions for the year.

FY2024 Management Guidance Core Change at CER (Non-IFRS)

| Item | FY2024 ORIGINAL MANAGEMENT GUIDANCE (May 2024) | FY2024 REVISED MANAGEMENT GUIDANCE (October 2024) |

|---|---|---|

| Core Revenue | Flat to slightly declining | Flat to slightly increasing |

| Core Operating Profit | Approximately 10% decline | Mid-single-digit % decline |

| Core EPS (Yen) | Mid-10s% decline | Approximately 10% decline |

FY2024 Reported and Core Forecasts

(Billion yen, except percentages and per share amounts)

| Item | FY2024 ORIGINAL FORECAST (May 2024) | FY2024 REVISED FORECAST (October 2024) |

|---|---|---|

| Revenue | 4,350.0 | 4,480.0 |

| Core Revenue (Non-IFRS) | 4,350.0 | 4,480.0 |

| Operating Profit | 225.0 | 265.0 |

| Core Operating Profit (Non-IFRS) | 1,000.0 | 1,050.0 |

| Net Profit | 58.0 | 68.0 |

| EPS (Yen) | 37 | 43 |

| Core EPS (Yen) (Non-IFRS) | 431 | 456 |

| Adjusted Free Cash Flow (Non-IFRS) | 350.0 - 450.0 | 400.0-500.0 |

| Annual Dividend per Share (Yen) | 196 | 196 |

Sign up for investor newsletter

Stay up to date on financial results, corporate milestones and learn how we're delivering on our commitment to patients, our people and the planet

Sign up